The Economics of Automation: Understanding Time Debt

Most companies track financial debt but ignore the much more corrosive force inside their operations: time debt. Time debt is the buildup of manual work, slow processes, inefficient handoffs, and data inconsistencies that drain hours from every team, every day.

Automation eliminates time debt the same way good financial systems eliminate waste: by creating predictable, compounding efficiency.

One-Sentence Definition

Time debt is the accumulated cost of wasted hours caused by manual, repetitive, or inconsistent workflows that slow down business operations.

1. What Time Debt Looks Like in Real Life

You’ll find time debt anywhere work piles up because humans are acting as the glue between systems.

Common signs include:

- constant status checks

- waiting for approvals

- manual data entry

- inconsistent team workflows

- repeated mistakes

Time debt grows silently until everything feels slow.

2. Why Time Debt Is More Expensive Than Financial Debt

Financial debt has predictable terms.

Time debt does not.

It compounds through:

- delayed projects

- slower customer response times

- increased error correction

- extra hiring just to “keep up”

- reduced output across departments

This leads to measurable revenue loss.

3. The Three Types of Time Debt

3.1 Process Debt

Outdated workflows that don’t scale.

3.2 Tool Debt

Tools that aren’t integrated, forcing manual bridging.

3.3 Knowledge Debt

Information stored in people’s heads instead of systems.

Automation reduces all three categories.

4. How Time Debt Slows Growth

When teams spend hours on repetitive work, they can’t:

- innovate

- improve workflows

- support larger volumes

- focus on high-value tasks

Time debt limits capacity more than budget does.

5. How Automation Pays Down Time Debt

Automation targets the biggest contributors to wasted time:

- repetitive tasks

- data syncing

- approvals

- updates across systems

- report generation

Each automated workflow removes a slice of time debt permanently.

6. The ROI of Eliminating Time Debt

Companies that reduce time debt benefit from:

- fewer errors

- faster projects

- improved team morale

- increased output

- reduced hiring needs

Time saved is capacity gained.

7. How to Measure Time Debt in Your Company

Start with two questions:

- How many hours per week does each process take manually?

- How many mistakes occur each week due to manual work?

Multiply those numbers across months and departments.

The hidden cost becomes brutally clear.

8. Prioritizing Which Time Debt to Eliminate First

Look for workflows that are:

- high-frequency

- high-risk

- prone to errors

- essential for customer experience

These produce the fastest ROI.

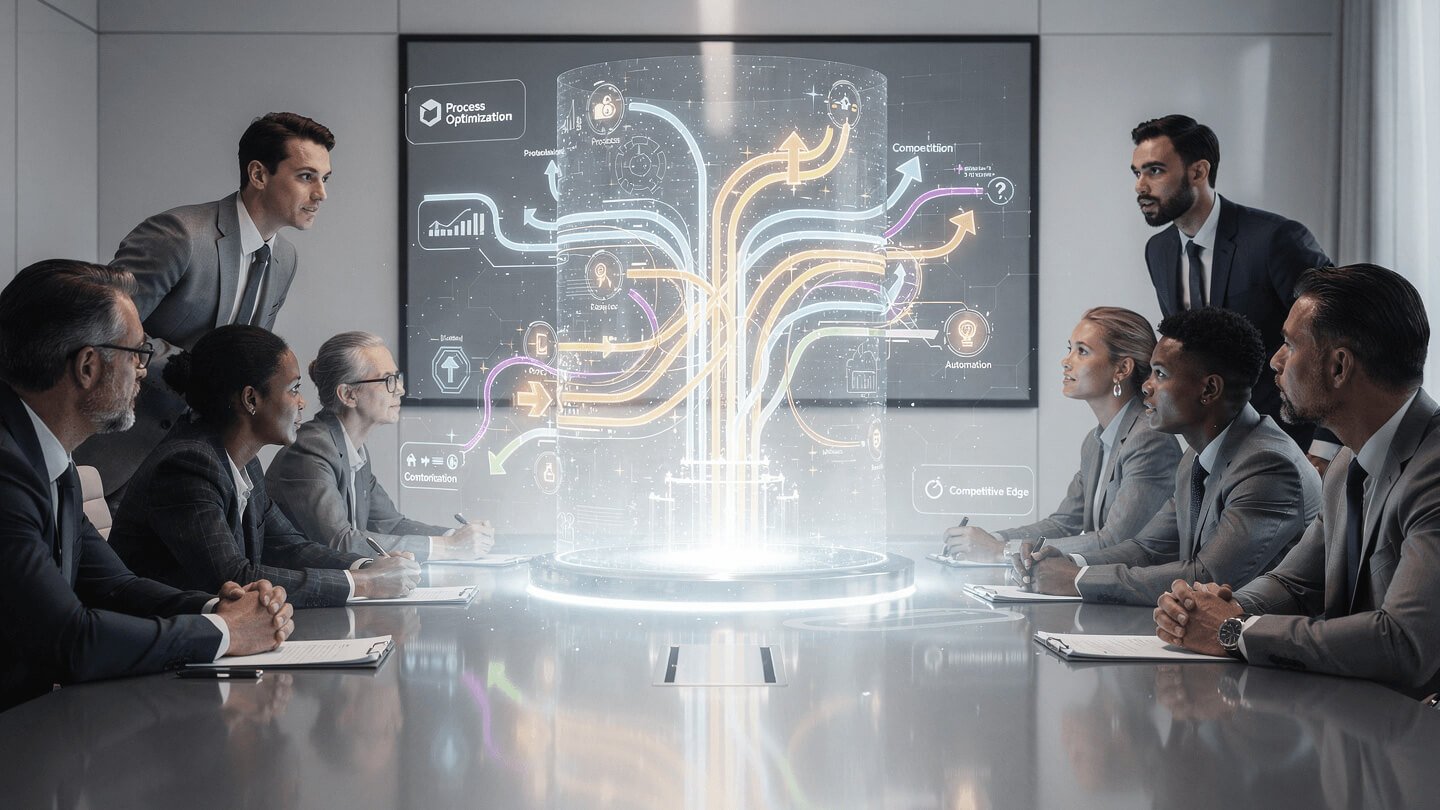

9. The Automation Flywheel: Compounding Benefits

As time debt shrinks, teams gain bandwidth.

That bandwidth gets reinvested into:

- improving processes

- expanding automation

- optimizing systems

This creates exponential operational leverage.

How SmartBuzz AI Helps Teams Erase Time Debt

We analyze your:

- task volume

- process complexity

- cross-system dependencies

- error patterns

Then we design automations that permanently eliminate the most costly time drains.

Your company moves faster than it ever has.

Voice Summary

- Time debt is the hidden cost of slow, manual workflows.

- It compounds like financial debt but is harder to see.

- Automation removes the repetitive tasks causing time debt.

- Eliminating time debt increases capacity and reduces hiring pressure.

- Companies grow faster when time debt is replaced with automation.

Mini FAQ

What is time debt?

Time debt is the accumulation of wasted hours caused by manual, repetitive tasks.

Why is time debt expensive?

Because it slows teams down, increases errors, and forces extra hiring.

How does automation reduce time debt?

Automation removes repetitive tasks, syncing work, and unnecessary handoffs.

How can a business measure time debt?

By calculating hours spent on manual work and errors each week.

What’s the long-term benefit of reducing time debt?

More capacity, faster projects, and a scalable operational foundation.